Debits and credits are a critical part of double-entry bookkeeping. They are entries in a business’s general ledger recording all the money that flows into and out of your business, or that flows between your business’s different accounts. A debit is a feature found in all double-entry accounting systems.

It breaks-out all the Income and expense accounts that were summarized in Retained Earnings. The Profit and Loss report is important in that it shows the detail of sales, cost of sales, expenses and ultimately the profit of the company. Most companies rely heavily on the profit and loss report and review it regularly to enable strategic decision making. The debit balance, in a margin account, is the amount of money owed by the customer to the broker (or another lender) for funds advanced to purchase securities. The debit balance is the amount of funds that the customer must put into their margin account, following the successful execution of a security purchase order, to properly settle the transaction. When you pay a bill or make a purchase, one account decreases in value (value is withdrawn, which is a debit), and another account increases in value (value is received which is a credit).

What are contra accounts and how do they work?

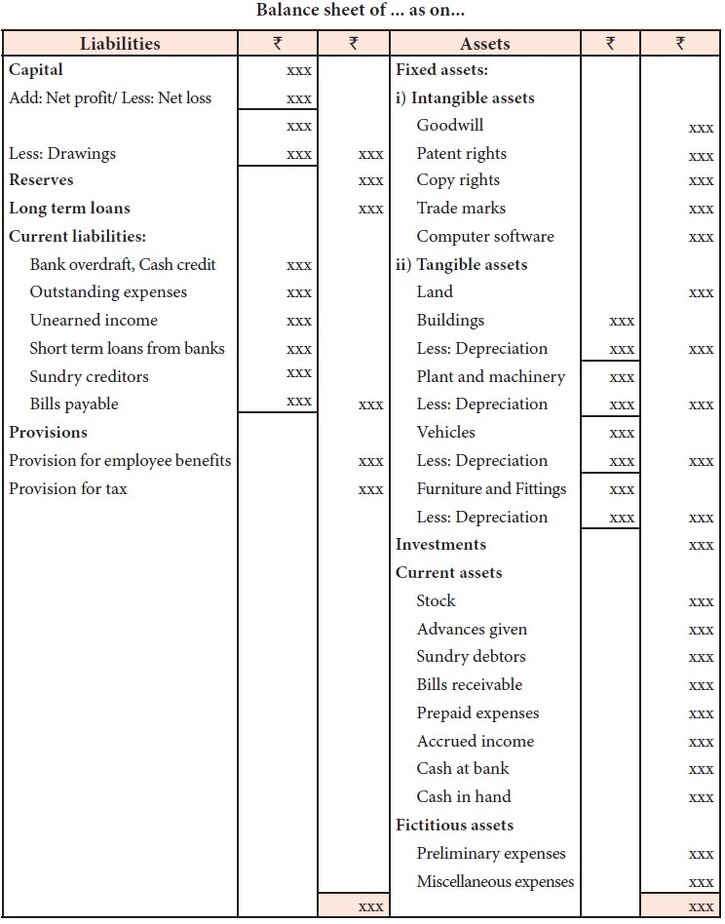

The table below can help you decide whether to debit or credit a certain type of account. In addition to this, we also offer remote bookkeeping service – where you just need to send us your invoices, bills, bank statements, etc and we record those transactions correctly in the accounting software. The debit balance refers to the balance that remains after one or a series of bookkeeping entries. This amount represents an asset or an expense of the entity.

So when the bank debits your account, they’re decreasing their liability. When they credit your account, they’re increasing their liability. All changes to the business’s assets, liabilities, equity, revenues, and expenses are recorded in https://accounting-services.net/bookkeeping-chula-vista/ the general ledger as journal entries. The total amount of debits must equal the total amount of credits in a transaction. Otherwise, an accounting transaction is said to be unbalanced, and will not be accepted by the accounting software.

Examples of debit

The basic principle is that the account receiving benefit is debited, while the account giving benefit is credited. An increase in a liability or an equity account is a credit. The owner’s equity accounts are also on the right side of the balance sheet like the liability accounts. They are treated exactly the same as liability accounts when it comes to accounting journal entries.

Therefore, the Machinery account will be debited (Dr.) by Rs 20,000 and the Cash account will be credited by Rs 20,000 (Cr.). Whenever a debit is created by your business, a credit must be created elsewhere. All “mini-ledgers” in this section show standard increasing attributes for the five elements of accounting. A debit note or debit receipt is very similar to an invoice. The main difference is that invoices always show a sale, where debit notes and debit receipts reflect adjustments or returns on transactions that have already taken place. That’s why we’ve built an easy-to-understand accounting software – ProfitBooks.

Liability Account

In an accounting journal, debits and credits will always be in adjacent columns on a page. Entries are recorded in the relevant column for the transaction being entered. Whereas a credit What is a debit? is considered as an accounting entry which works in the completely opposite manner by subtracting from asset or expense accounts and adding to liability, equity or revenue accounts.

When the total of debits in an account exceeds the total of credits, the account is said to have a net debit balance equal to the difference; when the opposite is true, it has a net credit balance. A dangling debit is a debit balance with no offsetting credit balance that would allow it to be written off. It occurs in financial accounting and reflects discrepancies in a company’s balance sheet, as well as when a company purchases goodwill or services to create a debit. Since the general ledger accounts have both a debit and credit side, or left and right side, the balance in a general ledger account will be either a debit balance or a credit balance. These steps cover the basic rules for recording debits and credits for the five accounts that are part of the expanded accounting equation.