Content

- Stay up to date on the latest accounting tips and training

- Depreciation Expenses as a Liability – Is Depreciation Expense an Asset or Liability?

- Accumulated depreciation

- Q8: What is the difference between fixed and current assets?

- Impact of Depreciation Methods

- Why Do Assets Lose Value Over Time? – What Is Accumulated Depreciation?

When depreciation treats as a debit, it reduces an asset’s value on the balance sheet. It means that cash available to pay for expenses is available sooner, and fewer funds are available to invest in other assets. The cash flow statement is designed to show the profit and loss from operations. It is reported as a separate line item called depreciation expense. The credit balance arises because depreciation over time reduces the value of an asset, reducing the cash available to pay for purchases.

The purpose of depreciation is used to match the timing of the purchase of a fixed asset (“cash outflow”) to the economic benefits received (“cash inflow”). An income statement reports a firm’s cumulative revenues and expenses from the inception of the firm through the income statement date. A decreasing balance approach accelerates the reporting of depreciation expenditure for assets in their early stages of useful life. An US corporation ABZ purchases heavy industrial machinery for $2,500,000. The company has a useful life of 6 years and a salvage value of $50,000 at the end of its useful life. Calculate the accumulated depreciation after 2,4, and 5 years of use.

Stay up to date on the latest accounting tips and training

Over the years, these assets may incur wear and tear, reducing the dollar value of those assets. Written-down value is the value of an asset after accounting for depreciation or amortization. Subsequent results will vary as the number of units actually produced varies. The simplest way to calculate this expense is to use the straight-line method. Depreciation expense is not an asset and accumulated depreciation is not an expense.

In accrual accounting, the “accumulated depreciation” on a fixed asset is therefore the sum of all depreciation since the date of original purchase. The adjusting entry for a depreciation expense involves debiting depreciation expense and crediting accumulated depreciation. Most businesses calculate depreciation and record monthly journal entries for depreciation and accumulated depreciation. The actual calculation depends on the depreciation method you use. Two of the most popular depreciation methods are straight-line and MACRS.

Depreciation Expenses as a Liability – Is Depreciation Expense an Asset or Liability?

Accumulated depreciation is a method of financial accounting that records an asset’s gradual loss of value over its lifetime. This loss is recognized as an expense over time, and the resulting decrease in the asset’s value can be used to calculate a company’s net worth. Accumulated depreciation can also determine how much tax a business must pay on its profits. In subsequent years, the aggregated depreciation journal entry will be the same as recorded in Year 1.

- Accumulated depreciation is the total amount of depreciation expense of a company’s assets.

- Over the course of an entity’s fiscal year, there is an increase in the depreciation expense account.

- However, when your company sells or retires an asset, you’ll debit the accumulated depreciation account to remove the accumulated depreciation for that asset.

- In essence, depreciation expense is recorded on the income statement just like any other normal business expense.

In essence, depreciation expense is recorded on the income statement just like any other normal business expense. Here, the asset is used in carrying out production, and in the process, it wears out. The depreciation amount is listed as an expense because it reflects the portion of the acquisition cost of the asset for the purpose of production.

Accumulated depreciation

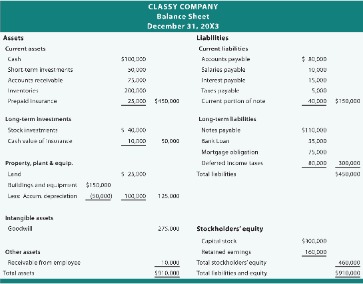

The four methods allowed by generally accepted accounting principles are the aforementioned straight-line, declining balance, sum-of-the-years’ digits , and units of production. The balance sheet provides lenders, creditors, investors, and you with a snapshot of your is accumulated depreciation a expense business’s financial position at a point in time. Accounts like accumulated depreciation help paint a more accurate picture of your business’s financial state. Companies can also use accumulated depreciation to depreciate assets more quickly in tax situations.

The balance of accumulated depreciation increases over time, adding the amount of depreciation expense recorded in the current period. Accumulated depreciation is an asset account with a credit balance known as a long-term contra asset account that is reported on the balance sheet under the heading Property, Plant and Equipment. The amount of a long-term asset’s cost that has been allocated, since the time that the asset was acquired. When a long-term asset is purchased, it does not make sense to recognize the purchasing price as an expense, because of the fact that it will be use for a prolonged period of time. Depreciation is an accounting method of spreading out the cost of these assets over the period in which the asset is useful.

Total depreciation charged on the asset of the company since the asset was purchased and used. The depreciation expense is used to compute the accumulated depreciation. It is also used in financial statements such as the balance sheet to indicate the depreciation worth of assets over time. Accumulated depreciation is the accruing depreciation of an asset.

The two balances have implications for financial reporting and for taxes. Depreciation expense is the periodic depreciation charge that a business takes against its assets in each reporting period. The intent of this charge is to gradually reduce the carrying amount of fixed assets as their value is consumed over time. Depreciation is used on an income statement for almost every business. It is listed as an expense, and so should be used whenever an item is calculated for year-end tax purposes or to determine the validity of the item for liquidation purposes.